How to Pick the Right Respondents for Your Survey

In our blog on “Choosing the right sample size”, we provided a formula to ensure your target population is represented accurately. Knowing that number early is important for determining your mail quantity and bidding out your project to vendors. However, it is only half the equation in survey sampling. The other half is making sure you pick the right people.

So how do you choose the participants?

1. Define Your Target Population

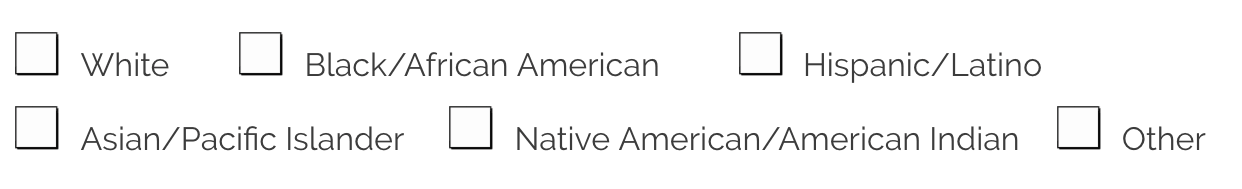

Before you can choose survey participants, you need to define the common binding characteristics or traits of the overall population. For example, “government employees” or “existing customers.” These are often combined with other characteristics: “government employees who use iPhones” or “existing customers who have utilized a particular service.” It is imperative to select the most appropriate target population to satisfy the objectives of the survey.

2. Identify Your List Source

Some survey samples are easier to generate than others. For example, if you are surveying your existing customers, you likely already have everything you need in your company database. But if your target is “Latina women 25-40 who shop online,” you may have some work to do. In this case, you may want to look for available public data or purchase a list from a sample provider. Once you determine the list you need, then you become better positioned to choose a sampling method and pick your respondents.

3. Choose a Sampling Method

There are many scientific ways to select a sample. They can be divided into two groups: probability and non-probability sampling. Probability sampling is any method that utilizes random selection like drawing straws or randomized computer selection. Everyone in a target group has an equal probability of being chosen. It is the preferred method of researchers because it accounts for bias and sampling error.

But sometimes probability sampling is not feasible, either due to time constraints or list accessibility. In that case, non-probability sampling is used. People must still meet common binding criteria, but they are chosen in such places as a mall or a busy neighborhood. Such samples are often useful but don’t account as easily for bias and sampling error.

Depending on the needs of your study, you will typically choose from one of the following common methods:

- Random Sampling – The purest form of probability sampling. The most basic example of this technique would be the lottery method.

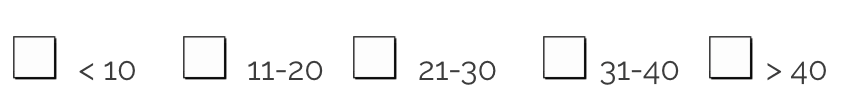

- Stratified Sampling – Identifies a subset of the target population such as fathers, teachers, females, etc., and selects them at random.

- Systematic Sampling– Uses every Nth name in a target list, where N is a variable of your choosing.

- Convenience Sampling – A non-probability method used when only a few members of the target population are available.

- Quota Sampling – Uses subset criteria like stratified, but doesn’t randomize their selection.

- Purposive Sampling – A method that uses predefined criteria with a purpose in mind. For example, gauging the perceptions of Caucasian females between 30-40 years old on a new product but not randomize their selection.

Survey sampling is a critical part of data collection. Your survey provider can help you weigh these options for your survey to ensure you get the quality data you need. For more information on survey sampling or any aspect of mail survey management, contact us today!