Five Ways to Avoid Survey Response Fatigue

We are now in an age where sending feedback requests or surveys has never been so easy. Technology has made online surveys popular and has streamlined telephone and mail surveys to be convenient as well. Target audiences are being flooded by survey requests that survey fatigue is inevitably happening.

Survey fatigue occurs when people are discouraged in responding to surveys because they are overwhelmed with the number of questions on a survey or bombarded with numerous surveys. In fact, in 2012, a report was made by Pew Research, their telephone survey response rates have dropped from 36% in 1997 to a mere 9%. With these results, it is essential to understand how to reduce survey response fatigue to improve overall survey response rates. Below we’ve listed five ways to avoid survey response fatigue for the benefit of your data collection project.

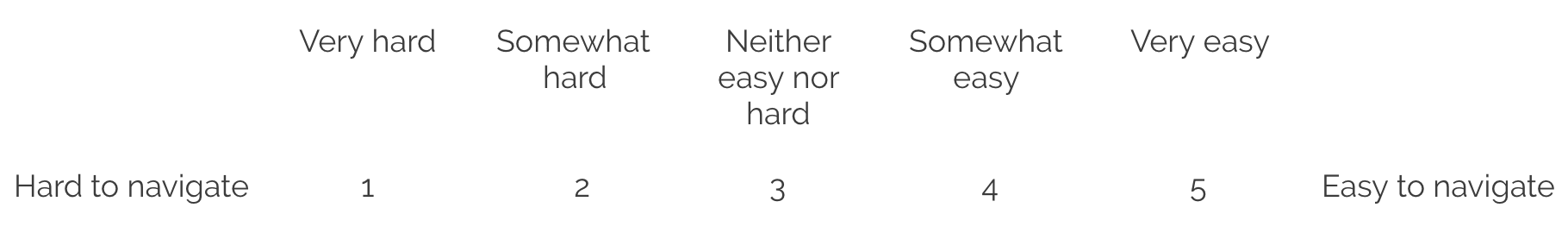

1. Filter Questions

Create surveys that will provide you with the most relevant and needed information. Remove unnecessary questions and use responses on earlier questions to further filter the survey from items that are looking for similar answers (although the way of questioning is different). Avoid gathering as much data as you can on a survey, instead keep your questions focused on meeting your survey goals.

2. Time Your Survey

Fewer questions do not automatically mean a shorter time for respondents to answer the survey. The survey questions’ complexity is a significant factor, so make sure to test the survey and how long it takes to finish. Surveys that take too long can tire participants, which results in lower quality data, non-completion, or total abandonment.

Manage expectations by advising respondents on how long the survey will take before they begin.

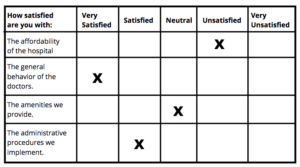

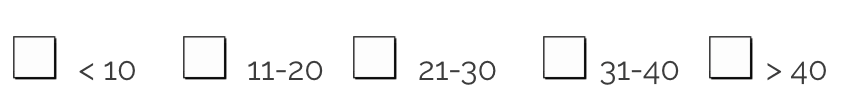

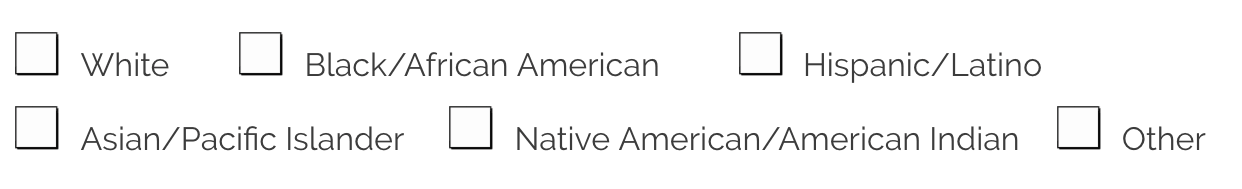

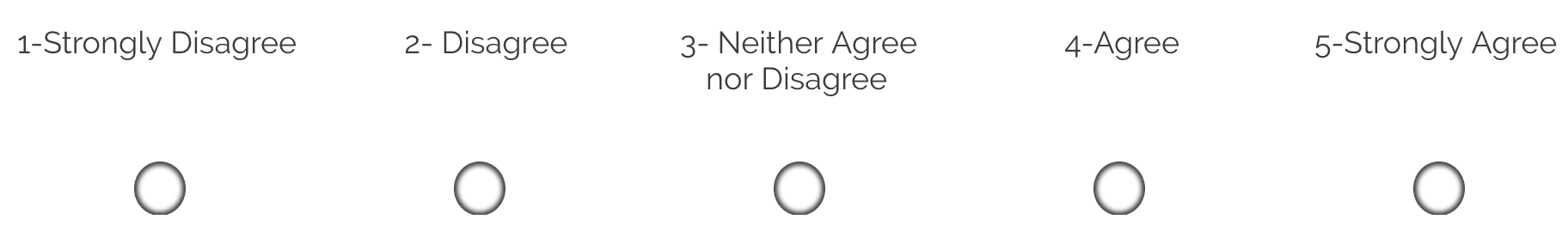

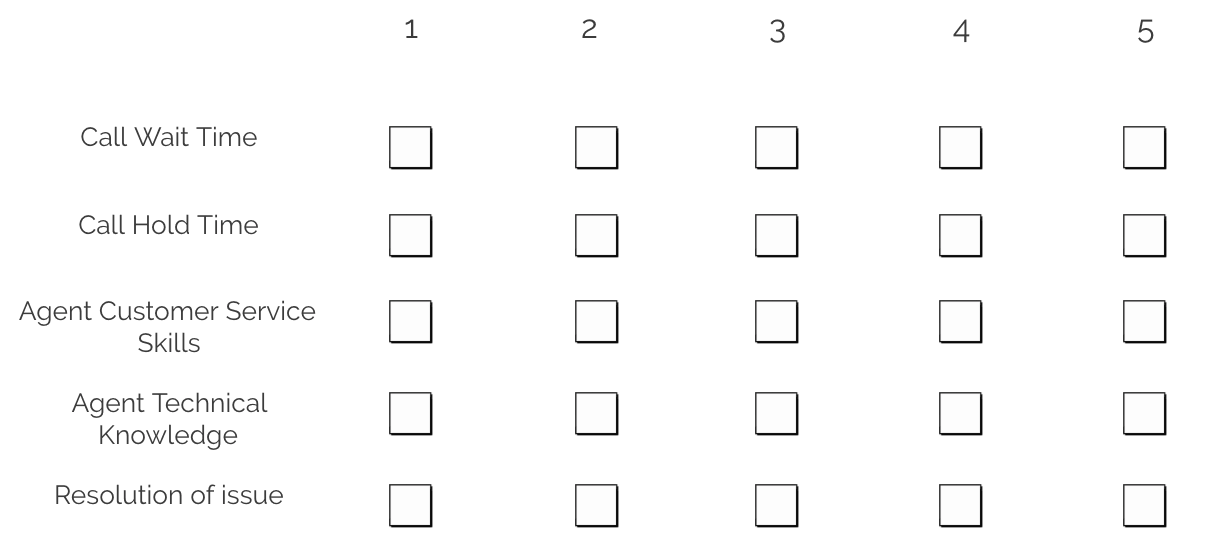

3. Keep Your Respondents in Mind

Focus not just on your research goals but on the people who will be providing data. Think about how they will feel about the questions, survey layout, and response options. Make notes on challenges or roadblocks the respondents may encounter, as well as check for bias in questions and remove them. Balancing the demand from stakeholders for additional data while maintaining a level of empathy will ultimately give you better data.

4. Communicate the Value

A study by Vision Critical determined that people are more likely to do a survey when they feel their opinion matters. Accordingly, a majority of the respondents (87%) claim they took the survey because they believed it would contribute to making a difference in a company’s product or services. For example: Advising respondents that the survey will help the business create their new menu will motivate respondents to participate, especially regular customers. It would also be helpful if the request came from someone with authority, like the owner of the establishment, to emphasize the importance of the survey.

5. Show Appreciation

Value the time and effort of your respondents. Provide respondents with incentives such as cash, promotion, or gift card. Check out our post on 3 Survey Incentives to Explode Your Response Rate. Another way to show appreciation is by allowing them to find out the results of the survey. Post the results online and reveal how the survey results are improving the brand.

There you have it, Five Ways to Avoid Survey Response Fatigue for your respondents to have a more pleasant survey experience, and get you higher response rates and quality data.

For more information on survey research services, Mail Surveys and Data Collection in general, contact DataForce!